Profit Predictions

We all know that a clear plan increases our chances of success. However, for the longest time I struggled with the idea of creating a budget for business performance. How on earth was I supposed to make a prediction about what would happen next week, let alone for the full year ahead.

I came to realise that a budget for your business doesn’t require a crystal ball, but instead it provides clarity of purpose. It gives you something to aim for and use as a benchmark for progress.

Given that creating a budget for your business is essential for growth and success, we need to have a plan in place. Perhaps you’re taking on this task yourself or working with your Bookkeeping and Accounting team. Either way these insights will help you to get the job done or make a useful contribution to building your business budget.

But first, what are the benefits of a budget for your business? A well-designed budget allows you to look ahead towards your ideal outcome, then plan and allocate resources effectively. It allows you to make informed decisions about expenses, revenue, cash flow, and allocation of profit. It also informs the pricing of your products and services, your ideal clients, and the marketing and communication strategy.

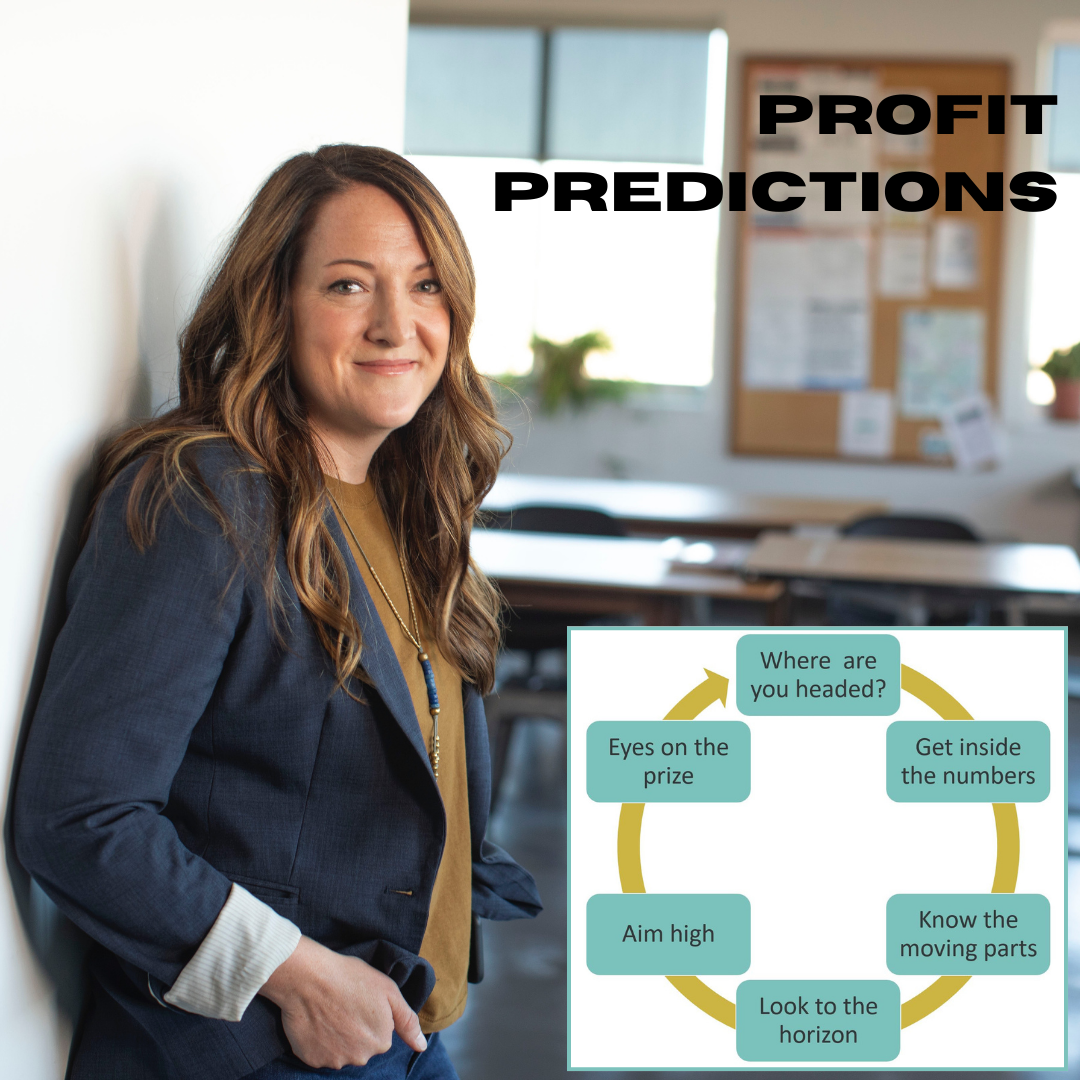

Here’s how to get started with preparing the budget inputs for your business.

- Where are you headed?

Before you create a budget, you need to identify your business goals and priorities. Start by asking yourself what you want to achieve in the next 12 months, and over the next few years. For instance, do you want to increase your revenue or reduce your costs? Are you planning to invest in new equipment to improve efficiency? Would you like to expand your team to win new contracts and increase your work/life balance? Once you have a clear understanding of your goals, you can start building a budget that aligns with them. - Get inside the numbers

The next step is to track your existing income and expenses. Generally, you can do this quite easily via accounting software such as Xero. Or if you’re planning a new venture, you can use a spreadsheet. Categorise your expenses by type, such as rent, wages, marketing, utilities, and materials etc. This will help you see where your money is going and identify areas where you can cut costs or invest more to lift your revenue and profit. - Know the moving parts

Fixed costs remain the same every month, such as rent, wages, and insurance. Variable costs fluctuate depending on usage and market forces, such as raw materials, overtime and bonus payments, utilities, and marketing. It’s important to distinguish between fixed and variable costs when creating a budget. This will help you meet your regular outgoings, prioritise other expenses, and adjust your spending accordingly. - Look to the horizon

Forecasting your revenue is a critical step in creating a budget. You need to estimate how much money your business will generate in the upcoming months or year. To do this, you can look at your sales history, market trends, and industry benchmarks. You should also consider any new products or services you plan to offer, as well as any changes in the market that may affect your revenue. - Aim high Based on your goals, expenses, and revenue forecast, you can set realistic targets for your business. These targets should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART goals). For instance, if your goal is to increase revenue by 20% in the next 6 months, you need to identify the actions required to get there. This is normally a combination of increasing sales, controlling, or reducing costs, optimising existing product sales, or launching something new; all while maintaining customer engagement and satisfaction. There’s definitely a lot to juggle so having a plan really helps.

- Eyes on the prize

Creating a budget is not a one-time task. You need to monitor the numbers regularly to ensure you stay on track. Compare your actual income and expenses to your budgeted amounts and adjust your actions accordingly. If you notice any significant variances, you need to investigate the cause and make course corrections as quickly as possible.

Remember, a budget aligned to your business (and personal) goals is not about predicting the future. But it is about proactively shaping and continually adjusting to give your business the best chance of success. In addition to being an excellent planning system, your budget is also a management tool which will help you stay competitive and profitable in the long run.

Enjoy building and staying on track with this financial plan for your business, and you’ll be on your way to even greater things.

Article credit: Sloan Wilkins – Executive Financial Coaching